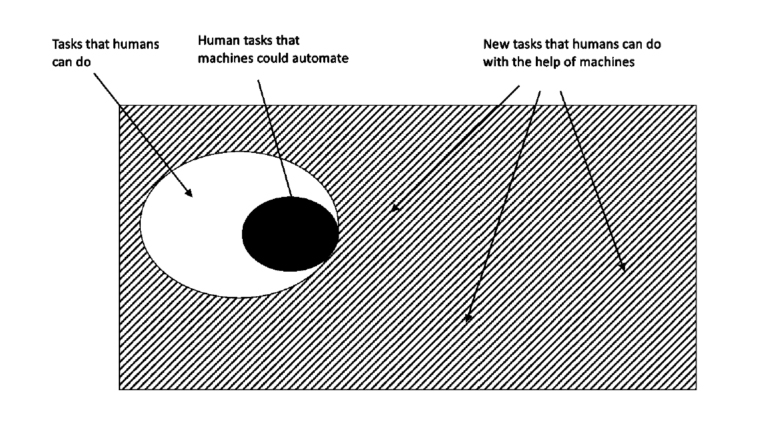

AI should augment not automate

Stanford’s Erik Brynjolfsson writes

The Turing Trap: The Promise & Peril of Human-Like Artificial Intelligence

The Turing Trap is when AI automates rather than augments human labor, concentrating welath and leaving others “trapped in an equilibrium where those without power have no way to improve their outcomes”

- “Zero marginal product people” are those whose skills (and intelligence) are below that of machines.

- Human knowledge is “inalienable”, i.e. can’t be transferred from one head to another

To the extent that a person controls an indispensable asset (like useful knowledge) needed to create and deliver a company’s products and services, that person can command not only higher income but also a voice in decision-making. When useful knowledge is inalienably locked in human brains, so too is the power it confers. But when it is made alienable, it enables greater concentration of decision-making and power.

It is often comparatively easier for a machine to achieve superhuman performance in new domains than to match ordinary humans in the tasks they do regularly

The Turing Trap amplifies abilities of

- Technologists

- Businesspeople

- Policymakers

Thought experiment: imagine some magic automation was applied to ancient Greece. You’d get rid of jobs like sheep herder and tunic weaver, but the society as a whole wouldn’t be better off — it’s still stuck in ancient technology.

AI may be able to read mammograms better than a human radiologist, but it cannot do the other twenty-six tasks associated with the job, according to O-NET, such as comforting a concerned patient or coordinating on a care plan with other doctors (Killock (2020))

Tom Mitchell and Daniel Rock on the suitability for machine learning found many occupations in which machines could contribute some tasks, but zero occupations out of 950 in which machine learning could do 100 percent of the necessary tasks.1

Or how Amazon revolutionized bookselling, not by automating cashiers, but by transforming the entire process.

Policymaking: tax code makes capital investment cheaper than labor investment2. Note that a fully-automated “lights-out” factory generates no taxes on the salaries that would have been paid.

References

Footnotes

Erik Brynjolfsson, Tom Mitchell, and Daniel Rock, “What Can Machines Learn, and What Does It Mean for Occupations and the Economy?” AEA Papers and Proceedings (2018): 43–47.↩︎

2021 top marginal federal tax rates on labor income of 37 percent, while long capital gains have a variety of favorable rules, including a lower statutory tax rate of 20 percent↩︎